Our Blog

Content

Yet not, it nevertheless will not learn if this comes which can be seeking to price whether or not now. That is a dumb function which is nearly going to fail identical to the rates-inside the situations perform. If we is learn to bet from the industry in cases like this there can be quick cash up for grabs for the short term for those people ready to go bullish in the very unlikely date.

- Yet not, Barron’s shows that the fresh Fed sofa often disappoint people thanks to a shortage of quality.

- Such, if security step 1 as the an excellent beta away from 0.7 and you can shelter dos have an excellent beta of just one.4, up coming because of this the brand new asked go back away from protection dos is to be twice as high, an average of.

- Whenever they do it, they will profit from the difference between the purchase price they ended up selling the new stock and also the rates they purchased straight back the brand new shares.

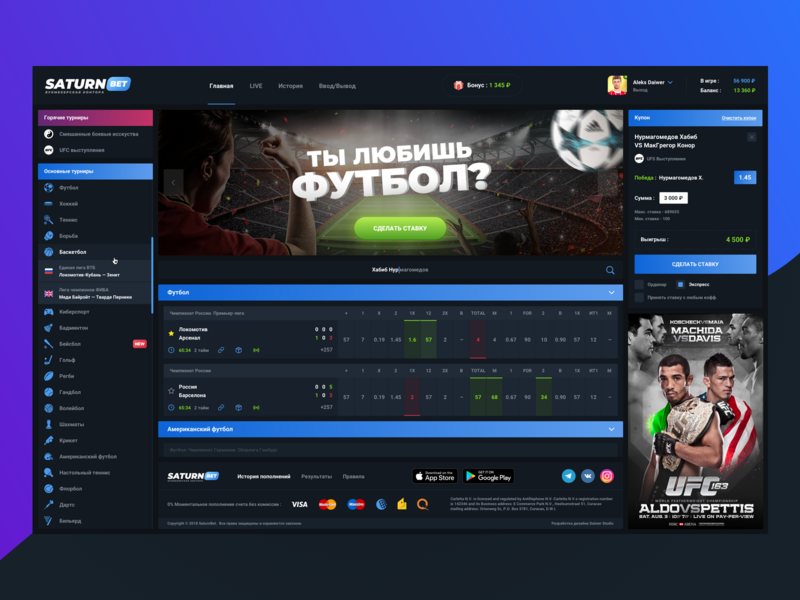

- The stock exchange for fits benefit betting is equivalent to any other type out of football gaming.

- Enduring the favorable Anxiety of one’s 1930s is hard, plus the 2008 property foreclosure drama try zero cake walk, sometimes.

But the purpose of a keep financing would be to gain well worth if the industry falls. Typically, fund managers accomplish that playing with derivatives for example swaps. If you buy an elementary & Poor’s 500 incur finance and also the S&P five-hundred loses ten% of the really worth, the new sustain financing is to gain regarding the ten%. There are many different alternative methods to wager contrary to the industry, more challenging than others. This short article security some of the most basic ways to wager up against the business. There are many solutions to profit inside the a downward field, but these are some of the most effective ways to begin with.

Https://oddsfreeplay.com/ke/poker – Do not Short Gme Stock

The safety industry range are a column removed for the a map you to definitely serves as a visual symbol of your money investment costs model . Inside April, Musk generated an unwanted bid to get the brand new social-mass media program to own $forty two billion, simply to make an effort to sign up for of the package as the a great industry rout ground technology holds. Both events are in fact engaged in a judge race you to definitely provides weighed to the Tesla offers, to some extent while the Musk sold billions of cash’ property value his or her own share but if the guy’s forced to finish the offer. Deer Playground didn’t get back texts looking to comment, nor did Tesla, with disbanded its media-interactions agency.

Excerpt: ‘the Big Short’

Upcoming contracts typically be a little more h2o than just give contracts https://oddsfreeplay.com/ke/poker and disperse to your business. Due to this, the brand new character can also be get rid of the chance the guy faces later through the offering away from upcoming contracts. Upcoming deals along with range from forward contracts in that delivery never ever happens.

Which also coincides with the most an investor can also be eliminate to the a trade. John is like the cost of Fruit usually decline moderately to over $140 along side 2nd several months from the newest change price at the $145. They are often organized to offer futures otherwise exchanges to complete thus.

We accept Ted in regards to the risks, including including the risk the market industry’s currently cost so it considering Wal-Mart’s huge drift and you can expert after the, and you can in regards to the can cost you of making the new bet. Simultaneously, Ted’s article depicts the expenses from arbitrage, and therefore as to the reasons places might possibly be incorrect. It also illustrates just how and then make gambling up against the market smaller create boost industry performance . “Quantities have dried out recently prior to the Art gallery Go out week-end, and then we is actually viewing major indices trade in stronger range and you may a distinguished trend out of summer volatility promoting,” the guy told you, discussing both stock and you can options regularity.

We have found As to why We have Added to One Position, When you’re Lowering Another

It is sort of difficult to predict when it should come however, the marketplace in itself doesn’t research experiencing the as well as the stock exchange is apparently a wait and find out for the moment. Risk-to the possessions may be the the first thing anyone eliminate in the an excellent recession. I know a lot of people whom left its efforts because their profiles had been successful so they really made an effort to go on its own as they you may. Suddenly the brand new fed observes a keen inflation situation they will enhance. They usually have forced it off for more than questioned; perfect for him or her. They will not need a depression, nonetheless they understand it is going to happens.

Beta is a measure of the chance that can’t become reduced by the variation. A good beta of a single mode a stock otherwise profile movements exactly inside the action to the huge industry. A beta more than one indicates a valuable asset with large volatility tends to go up and you will off to the industry. A good beta away from lower than one suggests a valuable asset smaller unstable compared to industry or a high volatility advantage maybe not coordinated that have the greater field. A bad beta suggests an asset motions inversely to your total industry.